Republished from Xconomy.

Energy innovation and investing are exploding right now. Technological breakthroughs are seen as perhaps the greatest hope to solving our dire energy challenge. However, what is often overlooked is the link between finding or creating new sources of energy and the effects on food and water.

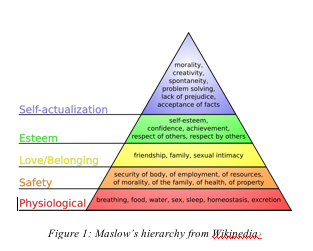

Indeed, if you think of energy as a coin, the flip side is water and food. The scary thing is that food and water are both lower on Maslow’s hierarchy of human needs—i.e., they are more fundamental to human survival. Yet, the current rush to create new sources of energy—including “clean” energy—may have potentially disastrous tradeoffs on our food and water supplies. Going forward, trading off energy creation for water—meaning creating new sources of energy that depend on heavy use of water, as many do—will be less and less acceptable. That’s why the most exciting opportunities in energy entrepreneurship and investment lie in strategies that create more water or energy without adversely affecting the other.

The Linkage of Energy and Water

At a fundamental level, we can think of the greatest and greenest energy producer in the world—the leaf—and observe through the process of photosynthesis that energy, water, and food are an interrelated system. But let’s also look at some other examples:

- Biomass—This is the most obvious source of tension between food, water, and energy today. Corn as a feedstock for ethanol has been a contributor to the dramatic rise in prices of this commodity and hence food (although the exact amount of its effect can be debated). The development of cellulosic ethanol will go a long way toward alleviating this tension by eliminating the dependence on corn or other foodstuffs for ethanol production. But there are also other, more subtle elements to the equation that add new sources of tension. Ethanol production from plants requires substantial amounts of water—and it must be clean, fresh water, which is the most precious kind. Biomass has been the poster child for the tension between alternative energy and water/food but it is far from alone.

- Nuclear—Traditionally, nuclear power plants have been built near large sources of water to promote cost-effective cooling.

- Enhanced Oil Recovery—After initial production starts to slow down, oil wells traditionally have been flooded with water to boost pressure and improve oil recovery. This made excellent economic sense in the past, and will be even more economically attractive with the new price levels for oil.

- New Heavy Oil Recovery—Heavy oil is viscous, harder to recover, and less economically attractive than the normal light sweet crude oil that is the standard today because of its costs of extraction and refinement. Driven by attractive new price levels and national security concerns, Canada is developing a large amount of this huge potential energy source in what is known as the “Tar Sands.” The increasingly preferred method to extract heavy oil a process called SAGD (steam assisted gravity drainage), which uses prodigious amounts of water.

These are only a few examples, but they illustrate the tight relationship between energy, food, and, especially, water today—a relationship that often forces painful tradeoffs when we try to produce more energy. But there are no laws of nature I am aware of that make this tradeoff necessary in perpetuity.

The Next Wave for Energy Innovation and the Future Focus for Productive Long-Term Energy Investing

I am often asked by investors and entrepreneurs, “What do you like with regard to the energy space?” My answer is twofold:

I am often asked by investors and entrepreneurs, “What do you like with regard to the energy space?” My answer is twofold:

1. Water and,

2. Any company that decouples energy and food/water. The company should produce or save energy without adversely affecting the water and/or food supply.

Water has been overlooked as an area for entrepreneurship and investment for good reason: it is a very challenging arena. Water is similar to energy in its diversity and the magnitude of challenges it presents (see What’s Wrong with Energy Investing Part II)—and it has even more conservative ultimate users and buyers. Nonetheless, water’s time in the limelight has come, and many companies built around clean water technology that couldn’t get a second look a year ago now are drawing tremendous interest. Often these companies have been around for over a decade because that is how long it has taken such ventures in the past to get traction. In addition, new companies like NanoPur, a venture involving the use of novel carbon nanotube technology to improve the energy efficiency and cost effectiveness of desalination (and a finalist for the recent MIT Clean Energy Entrepreneurship Prize backed by NSTAR and the U.S. Department of Energy), are springing up with much higher frequency. The new economics of water make companies that increase the supply of clean water a compelling value proposition that will only increase over time. While there may be alternative energy sources and fuels, there really is no substitute for clean water.

The second point I raised above is really a necessary condition for building sustainable energy companies in the future. Only a year or so ago, venture capitalists routinely asked each new potential investment company about its India and China strategies. Similarly, for energy companies, the question will be, “What effect will the venture have on food and water?” Those companies that can decouple the tradeoffs between the two will be interesting, and those that do not, will not be attractive investments. Even existing, well-managed energy companies are now closely examining this issue, which will only increase in importance. An example of a potentially exciting new company in this regard is another finalist from the aforementioned MIT Energy Prize competition: Sequesco. This team of three PhDs plans to develop genetically modified non-photosynthetic bacteria (an approach different than photosynthesis-based algae production) to more efficiently convert harmful CO2 into biomass fuel. This is a double play (i.e., it decreases CO2 emissions and increases energy supplies) without negative ramifications on water or food—at least that we know of yet.

In summary, trading off water for energy is a devastatingly bad idea, for as wise old Benjamin Franklin said, “When the well is dry, we learn the value of water.” In the first stage of energy innovation, we began to deplete the well. But in the second stage, beginning now, we must move on from this folly and find more intelligent solutions.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

How relevant was this article to you?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

We are sorry that this article was not useful for you!

Let us improve this post!

Tell us how we can improve this post?