The Next Big Thing in Energy Innovation and Investing? Let’s Talk Water

Republished from Xconomy.

Energy innovation and investing are exploding right now. Technological breakthroughs are seen as perhaps the greatest hope to solving our dire energy challenge. However, what is often overlooked is the link between finding or creating new sources of energy and the effects on food and water.

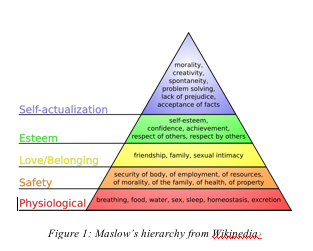

Indeed, if you think of energy as a coin, the flip side is water and food. The scary thing is that food and water are both lower on Maslow’s hierarchy of human needs—i.e., they are more fundamental to human survival. Yet, the current rush to create new sources of energy—including “clean” energy—may have potentially disastrous tradeoffs on our food and water supplies. Going forward, trading off energy creation for water—meaning creating new sources of energy that depend on heavy use of water, as many do—will be less and less acceptable. That’s why the most exciting opportunities in energy entrepreneurship and investment lie in strategies that create more water or energy without adversely affecting the other.

The Linkage of Energy and Water

At a fundamental level, we can think of the greatest and greenest energy producer in the world—the leaf—and observe through the process of photosynthesis that energy, water, and food are an interrelated system. But let’s also look at some other examples:

- Biomass—This is the most obvious source of tension between food, water, and energy today. Corn as a feedstock for ethanol has been a contributor to the dramatic rise in prices of this commodity and hence food (although the exact amount of its effect can be debated). The development of cellulosic ethanol will go a long way toward alleviating this tension by eliminating the dependence on corn or other foodstuffs for ethanol production. But there are also other, more subtle elements to the equation that add new sources of tension. Ethanol production from plants requires substantial amounts of water—and it must be clean, fresh water, which is the most precious kind. Biomass has been the poster child for the tension between alternative energy and water/food but it is far from alone.

- Nuclear—Traditionally, nuclear power plants have been built near large sources of water to promote cost-effective cooling.

- Enhanced Oil Recovery—After initial production starts to slow down, oil wells traditionally have been flooded with water to boost pressure and improve oil recovery. This made excellent economic sense in the past, and will be even more economically attractive with the new price levels for oil.

- New Heavy Oil Recovery—Heavy oil is viscous, harder to recover, and less economically attractive than the normal light sweet crude oil that is the standard today because of its costs of extraction and refinement. Driven by attractive new price levels and national security concerns, Canada is developing a large amount of this huge potential energy source in what is known as the “Tar Sands.” The increasingly preferred method to extract heavy oil a process called SAGD (steam assisted gravity drainage), which uses prodigious amounts of water.

These are only a few examples, but they illustrate the tight relationship between energy, food, and, especially, water today—a relationship that often forces painful tradeoffs when we try to produce more energy. But there are no laws of nature I am aware of that make this tradeoff necessary in perpetuity.

The Next Wave for Energy Innovation and the Future Focus for Productive Long-Term Energy Investing

I am often asked by investors and entrepreneurs, “What do you like with regard to the energy space?” My answer is twofold:

I am often asked by investors and entrepreneurs, “What do you like with regard to the energy space?” My answer is twofold:

1. Water and,

2. Any company that decouples energy and food/water. The company should produce or save energy without adversely affecting the water and/or food supply.

Water has been overlooked as an area for entrepreneurship and investment for good reason: it is a very challenging arena. Water is similar to energy in its diversity and the magnitude of challenges it presents (see What’s Wrong with Energy Investing Part II)—and it has even more conservative ultimate users and buyers. Nonetheless, water’s time in the limelight has come, and many companies built around clean water technology that couldn’t get a second look a year ago now are drawing tremendous interest. Often these companies have been around for over a decade because that is how long it has taken such ventures in the past to get traction. In addition, new companies like NanoPur, a venture involving the use of novel carbon nanotube technology to improve the energy efficiency and cost effectiveness of desalination (and a finalist for the recent MIT Clean Energy Entrepreneurship Prize backed by NSTAR and the U.S. Department of Energy), are springing up with much higher frequency. The new economics of water make companies that increase the supply of clean water a compelling value proposition that will only increase over time. While there may be alternative energy sources and fuels, there really is no substitute for clean water.

The second point I raised above is really a necessary condition for building sustainable energy companies in the future. Only a year or so ago, venture capitalists routinely asked each new potential investment company about its India and China strategies. Similarly, for energy companies, the question will be, “What effect will the venture have on food and water?” Those companies that can decouple the tradeoffs between the two will be interesting, and those that do not, will not be attractive investments. Even existing, well-managed energy companies are now closely examining this issue, which will only increase in importance. An example of a potentially exciting new company in this regard is another finalist from the aforementioned MIT Energy Prize competition: Sequesco. This team of three PhDs plans to develop genetically modified non-photosynthetic bacteria (an approach different than photosynthesis-based algae production) to more efficiently convert harmful CO2 into biomass fuel. This is a double play (i.e., it decreases CO2 emissions and increases energy supplies) without negative ramifications on water or food—at least that we know of yet.

In summary, trading off water for energy is a devastatingly bad idea, for as wise old Benjamin Franklin said, “When the well is dry, we learn the value of water.” In the first stage of energy innovation, we began to deplete the well. But in the second stage, beginning now, we must move on from this folly and find more intelligent solutions.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

What’s Wrong with Energy Investing? Part 2

Republished from Xconomy.

I had the good fortune to receive a substantial amount of feedback on my first post on this subject a few weeks ago. The feedback was productive and helped to clarify key points and in general reinforced my conviction laid out in the Part I entry. In that article, I advanced the idea that while “we should and must invest in renewables and alternative energy for the future,” to do so to the exclusion of hydrocarbons means “we are majoring in minors.”

My point was simply that a more balanced approach to our energy investments should be pursued that focuses as well on the hydrocarbon reality we face for the foreseeable future. While we develop alternatives for the longer term, I argued, we must simultaneously invest in making hydrocarbons a cleaner, more efficient form of energy—as well as energy efficiency initiatives. “Just to put this in perspective,” I wrote, “…If we could find a way to reduce CO2 emissions from automobiles by 1 percent it would be, from a quantitative and practical point of view, thousands of times more positively impactful than increasing solar energy production by a hundred times.”

The post generated a lot of comments, but the numbers behind my argument are quite compelling in the end, so I can’t say that my view has changed. My second installment on this subject will be regarding a topic that is much harder to qualify. But I believe it is another fundamental, yet often-overlooked factor that has to be dealt with more realistically if energy investing is to succeed: our critical shortage of energy entrepreneurs. Clearly, money for energy innovation is no longer an issue, but the entrepreneurs to effectively put that capital to work will prove to be a system constraint.

People in many industries will whine and complain about how their industry is so unique and more difficult than others, and so one has to sort through this groaning to find the truth. After some close analysis, though, I have concluded that for energy, unfortunately, it is definitely true. Energy entrepreneurship is much harder than entrepreneurship in other sectors, and I believe most investors have yet to come to grips with this fact.

To explain my case, I will break the discussion down into some key points (which follow below). These are general points about energy ventures and so may not apply specifically to individual cases—but in aggregate I believe them to be true. They present a real challenge for the energy sector today and into the near future.

All Entrepreneurs Are Not Alike, or Energy Entrepreneurs Are A Rare Breed Indeed

When new industries arise (e.g., computer hardware, software, telecom, internet, wireless, medical, biotech), they have their own unique characteristics. Obviously, the technical talent required differs greatly in these industries, but so do the entrepreneurial skills required. Entrepreneurs are the change agents who commercialize the disruptive invention, and the inventor (a technologist or some sort of visionary) needs them to create a meaningful new venture. The entrepreneur is the great integrator and the propeller of the new venture.

An entrepreneur who is successful in software usually is particularly skilled at identifying market opportunities and then executing a market-pull, customer-intimate, product strategy in a rapid fashion—getting innovations to market quickly and then iterating to improve the products. These skills are clearly transferable to Web 2.0 venture creation but are not as relevant, and, in fact, may be counterproductive, in a biotech entrepreneurial venture. Biotech entrepreneurs need to have a much more methodical approach over a longer period of time than Web entrepreneurs, and they must possess a distinct ability to manage a company and a project through significant regulatory obstacles. Similarly, as I will explain further, Energy Entrepreneurship is much different than any brand of entrepreneurship we have seen to date. In fact, I would argue that being an entrepreneur in the energy arena is unquestionably the hardest form of entrepreneurship by at least one order of magnitude.

While it’s easy for me to say that energy entrepreneurship is harder than entrepreneurship in other sectors, it’s a bit presumptuous of me to estimate how much tougher it is. I do so, however, to make the point that there is a big gap between it and other fields that people are underestimating right now. Let’s look at all the attributes or dimensions of expertise that an Energy Entrepreneur needs:

1. Multi-dimensional knowledge of science and engineering disciplines. While the entrepreneur is most often not the technologist or inventor, he (note: I use “he” and “his” in the gender neutral sense) does need to understand the core scientific drivers of the market as well as the technology or science drivers behind his various product offerings. For many new Energy Ventures that could well mean possessing an understanding of aspects of chemistry, biology, engineering, biotechnology, environmental science, computer science, and production systems, to name just a few. Does that make energy entrepreneurship unique amongst technology sectors? To the magnitude that such expertise is required, yes.

2. Longer time frame. While there are exciting exceptions like EnerNOC (NASDAQ: ENOC), the time frame required for an energy company to get traction is much longer than with companies in most other sectors. Ann Winblad, the software venture capitalist, said at the recent MIT Technology Review Emerging Technologies Conference that her companies took a long time to bear fruit—an average of 6.2 years. While for Ann that may seem long, most energy companies, even poster success stories like EverGreen Solar, can only dream of such short time horizons. While the current enthusiasm for energy companies is compressing the time before they bear fruit, the historical starting point (for good reasons) is significantly greater than 10 years. Indeed, if the time required for energy companies to bear fruit could be reduced to an average of 10 years, it would be a substantial improvement (Which raises a question as to how venture capitalists with 10-15-year funds can handle energy investing, but we must keep moving and stick to the main topic…). The persistence and patience that Ann said is so difficult to find for typical software startups is a fraction of what is required for energy companies. Biotech companies are similar in this regard, but in general, energy is far outside the bounds of other sectors.

3. Bigger scope and scale from a financial standpoint. Just from a financial standpoint, a typical energy new venture requires large amounts of capital. Investors have to make significant initial bets and then be ready to follow them up with even bigger bets. While energy is not unique (biotech, telecom, and now wireless—see Helio—come to mind as similar stories), it does add another dimension of required sophistication.

4. Ability to deal with public perception and often-intense emotion. Energy is inextricably tied to controversial natural resources, public safety, and environmental issues—not to mention questions about economic impact. Part and parcel with this come public politics and emotion. Some of it is clearly justified, and some of it is not. But, as ex-football coach Bill Parcells said, “it is what it is,” and the energy entrepreneur needs to be adept at dealing with it. (See the comments on my first post for evidence of this tendency.)

5. Adroitness in governmental affairs. Energy is not just emotional—it is politically charged with a significant policy dimension. If one chases down the full value chain of energy-related products, he or she will almost always find that they are directly affected by governmental actions. This action can be regulation (such as utility rate setting in the U.S.), subsidies (e.g, U.S. or Brazil ethanol production or Germany’s solar industry) or price setting (think OPEC). This is generally something entrepreneurs (and venture capitalists) hate. It’s not unique to the energy sector: the medical and biotech arenas have similar considerations. Strong capability and comfort in dealing with government affairs relating to policy and economic issues is absolutely critical to the successful energy entrepreneur.

Any one of these factors alone adds complexity to the already challenging task an entrepreneur faces, but the challenge becomes particularly daunting when the compounding effect is considered.

Numerous Routes for Attackers in Other Fields, Not in Energy

In addition to these traits, there is another important and challenging market condition that exists in energy that is fundamentally different from other high tech industries today. It is the imperative to effectively deal with (e.g., by partnering, collaborating, or at least neutralizing) the very people you are trying to disrupt. To a much greater degree than in other sectors the existing hierarchy in energy cannot be ignored.

Entrepreneurs thrive as “attackers” armed with disruptive technologies, business models, or other ideas that they bring to bear against the “defenders”—specifically the entrenched, resource-endowed hierarchy that is being threatened. Since the demise of IBM’s monopoly (Isn’t it hard to fathom that less than 25 years ago the biggest concern IBM had was anti-trust suits because it dominated the computer market so completely?), there have been multiple options for technology-based entrepreneur-attackers to create new products and to get to market. There has not been a dependence on a real or de facto monopoly on the defender side. It has been relatively easy to bypass the defender completely, or use defenders against each other to get the disruptive innovation to market.

For example, when Lotus came up with its breakthrough 1-2-3 spreadsheet, it did NOT have to work with IBM to have it fit into IBM’s closed mainframe architecture. It could operate on the open personal computer platform. Today, when Web 2.0 companies arise, there are no monopolies controlling the infrastructure that they need to deliver their offerings to customers.

Contrast this to the entrepreneur who wants to harness wind energy in the Dakotas and finds that there is no grid available to deliver the energy to the customer. To solve this problem would require dealing with numerous de facto monopolies (including utility companies but also state, local, and federal governments) that ultimately make the problem essentially intractable.

Energy entrepreneurs, especially those in energy production, don’t enjoy the luxury of having numerous possible routes to market—because it is almost always the case (even though they try to avoid it if they can and a few succeed) that they must deal with the existing hierarchy, which controls the infrastructure.

This is a difficult challenge in general because existing successful hierarchies are very content in homeostasis and resist significant changes (as Clayton Christensen details in The Innovator’s Dilemma). In energy, it is even significantly more challenging because those controlling the infrastructure are notoriously (and appropriately) conservative beyond what would be seen in other industries. While renewable and energy efficiency entrepreneurs might complain about utilities (sometimes with justification), they don’t have an option but to deal with them. Building a parallel grid is not a viable option. They must find extremely creative ways of working with the controllers of the infrastructure. Likewise, to be a player in the massive oil and gas industry, entrepreneurs usually need to find a way to work with those who control that infrastructure. The costs of the infrastructure are just so high in energy that having multiple options is much less likely than in other industries. It is not simply a barrier that was created because someone “built a brand”—there are huge costs required to build the infrastructure which cannot be overcome with a marketing program.

In Summary, Thoughts and Action on the Solution

As Albert Einstein said, “seek simplicity and distrust it.” The model I am proposing is not relevant for all energy startups, but it is for the majority of impactful new ventures that should and need to be created. The energy entrepreneur has to be able to manage significant technical resources to address the multidimensional science, engineering, and systems challenges which alone would exceed the entrepreneurial requirements for any other industry. If that were all, it would be enough—but it is not.

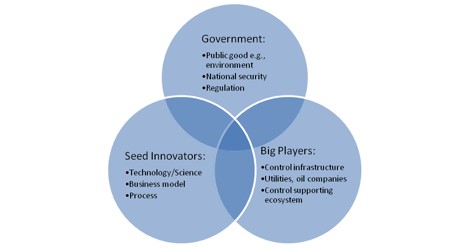

Like the most elite hi gh-tech entrepreneurs, the Renaissance Energy Entrepreneur must have these multi-disciplinary science and technology skills like an elite high-tech entrepreneur, represented in the “Seed Innovators” circle in the model to the right. These include understanding and building innovative business models to optimize monetization, as well as a keen awareness of the standard successful new venture creation process. This must be managed over a long period of time while simultaneously addressing the other two circles shown in the diagram—the “Government” (policy and public relations) circle and the “Big Players” circle (representing the need to diplomatically and effectively “massage the existing controllers of the infrastructure”). This combination is what makes this an exponentially more difficult task. The Energy Entrepreneur today who can do this is very rare indeed and in huge demand.

gh-tech entrepreneurs, the Renaissance Energy Entrepreneur must have these multi-disciplinary science and technology skills like an elite high-tech entrepreneur, represented in the “Seed Innovators” circle in the model to the right. These include understanding and building innovative business models to optimize monetization, as well as a keen awareness of the standard successful new venture creation process. This must be managed over a long period of time while simultaneously addressing the other two circles shown in the diagram—the “Government” (policy and public relations) circle and the “Big Players” circle (representing the need to diplomatically and effectively “massage the existing controllers of the infrastructure”). This combination is what makes this an exponentially more difficult task. The Energy Entrepreneur today who can do this is very rare indeed and in huge demand.

First, we need to openly recognize the challenge in front of us and not believe there are simple solutions. I recently heard a very smart venture capitalist say that he plans to “take successful entrepreneurs from other industries who want to give back now and put them in energy.” In general, I find this approach sorely lacking. For a sports analogy (which is a bit of a stretch I know, but it makes my point), transferring Michael Jordan’s extremely prodigious mental and physical athletic talents from basketball to baseball didn’t really work—nor will it generally work in energy entrepreneurship. The idea of transferring entrepreneurs from other industries and putting them in energy may be our only option in the short term, but they risk getting whiplash as they seek to master steep learning curves in multiple dimensions.

At MIT, starting in our “Energy Ventures” class, we seek to build this new renaissance energy entrepreneurship capability by having multi-disciplined teams working off the model above. We have selected a number of the most talented and passionate students at MIT from multiple science disciplines and coupled them with top policy graduate students and MBAs with significant energy background and put them into teams to work on building new energy companies. We are watching the experiment with great interest. The full results are not in, but we do know that it is much different and much harder than most people realize.

There are many other efforts to cultivate energy entrepreneurship in organizations such as the MIT Energy Club, MIT Enterprise Forum, TIE (The Indus Entrepreneurs), and the like. We plan to create a unified competition platform (the MIT Energy Prize) with significant support for prospective energy entrepreneurs inside and outside our community to help audition and improve their skills in a highly constructive, networking environment. It will be a learning process for everyone.

While there is still much to learn, we do know that in time, through these efforts (and many others), a new breed of entrepreneurs, the energy entrepreneurs, will arise to meet the challenges of the energy sector. When that day comes, another major bottleneck to resolving the energy challenge will be removed. But until then, we must recognize the limit in the system and act appropriately.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

What’s Wrong with Energy Investing? Part 1

Republished from Xconomy.

I just returned to Kendall Square after spending a spectacular weekend at Squam Lake in New Hampshire and at the forefront of my mind—and what I could not shake over the weekend—is the state of the development of the New England energy ecosystem. Granted, I have a personal agenda, as in 30 days I commence teaching a new class at MIT called Energy Ventures. Still, it’s an extremely relevant question for the local economy, and arguably the nation and the world. Energy is, after all, the biggest industry on the planet and certainly faces the biggest challenges. Therefore, it offers the biggest and most attractive opportunities for investors and others who want to make a difference.

A lot of smart and well-intentioned people have made a lot of progress in recent years in developing the regional energy ecosystem. But let’s not congratulate ourselves too fast. For every EnerNoc success story, there has been a GreenFuel setback (hopefully temporary). Not that such setbacks are necessarily a bad thing, especially if they cause us to reflect and learn how to improve. So the question that we should seek to answer is “what is working and what is not working in developing a New England-based energy ecosystem?” Or even more specifically, “what’s wrong with energy investing?”

To answer this question, we might refer to the Beatles’ George Harrison, who sang in “Got My Mind Set on You” that “it’s gonna take time, a whole lot of precious time…to do it right.” But the time is precious indeed, and I think enough results are in to make two important points about energy investing.

Majoring in Minors

While there clearly used to be a shortage of private equity capital for energy ventures (and rightly so because of their highly cyclic nature), that problem has gone away. Money is now gushing in. By my simple calculations, the amount of money available to energy ventures from dedicated private-equity funds quadrupled from 2005 to 2006, soaring from approximately $5B to $20B. I believe this is even understated. The point is that the money is flowing in at an amazing rate. But where is it going? Energy as a sector is almost as non-specific as technology or transportation. We have to peel back the label and take a closer look.

The lion’s share of the money that is dedicated to energy is earmarked for renewable or alternative energy. Renewable or alternative energy is a fantastic thing and it is necessary, but wholly insufficient, to deal with the energy problem. The biggest part of the energy riddle that needs to be solved resides—and will continue to reside for the next 50 years—with the hydrocarbon side. How do we find more to meet the booming demand? And, how do we find ways, through technology, process, and/or business-model innovation, to reduce the environmental impact of hydrocarbon usage? Renewables is a rounding error when compared to the 80 to 90 percent of the demand that hydrocarbons (i.e., oil, gas, coal—ah!, there it is the four-letter word of energy) fill and will continue to fill for the foreseeable future.

We should and must invest in renewables and alternative energy for the future and there will be some big wins there relative to investing. But with all the new money and attention rushing into this small part of the sector, we are majoring in minors. The major focus should be how do we deal with the continued need for hydrocarbons and how do we make this cleaner energy. Just to put this in perspective, the world would be dramatically better off from an energy-supply standpoint if we could find a way to improve recovery rates at oil and gas wells by 1 percent than if we built a million new wind turbines. If we could find a way to reduce CO2 emissions from automobiles by 1 percent it would be, from a quantitative and practical point of view, thousands of times more positively impactful than increasing solar energy production by a hundred times.

For the investor, this line of thought would seem to make sense as well. One of the top funds of any kind in the U.S. last year was First Reserve Corporation, and while they do not release their results, we know they did very well. One gauge is that they were the top fee producer on Wall Street last year. They also just raised an additional $7.8 billion to continue to do what they do best—investing in the basic energy industry with a focus on making the good old hydrocarbons industry more effective and efficient. These days the herd mentality of private-equity investors, in my humble opinion, has them putting too much money into renewable/alternative energies and not enough into fixing the core business of energy, the hydrocarbons. There will be a correction but until such time, I think this is a fundamental problem with overall energy investing.

Not Enough of the New Brand of Innovators/Entrepreneurs

The nature of the energy industry is far different from that seen in IT, healthcare, biotech, telecommunication, or any other field and it requires a new brand of innovator/entrepreneur which is in short supply relative to demand. The lessons from other industries do not translate effectively in many cases. The scope, scale, time horizon, interdisciplinary skills required, and the question of how independent a new venture can be from the existing infrastructure are problems that, in combination, are unique to the energy industry. But more on that in the next post…

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.